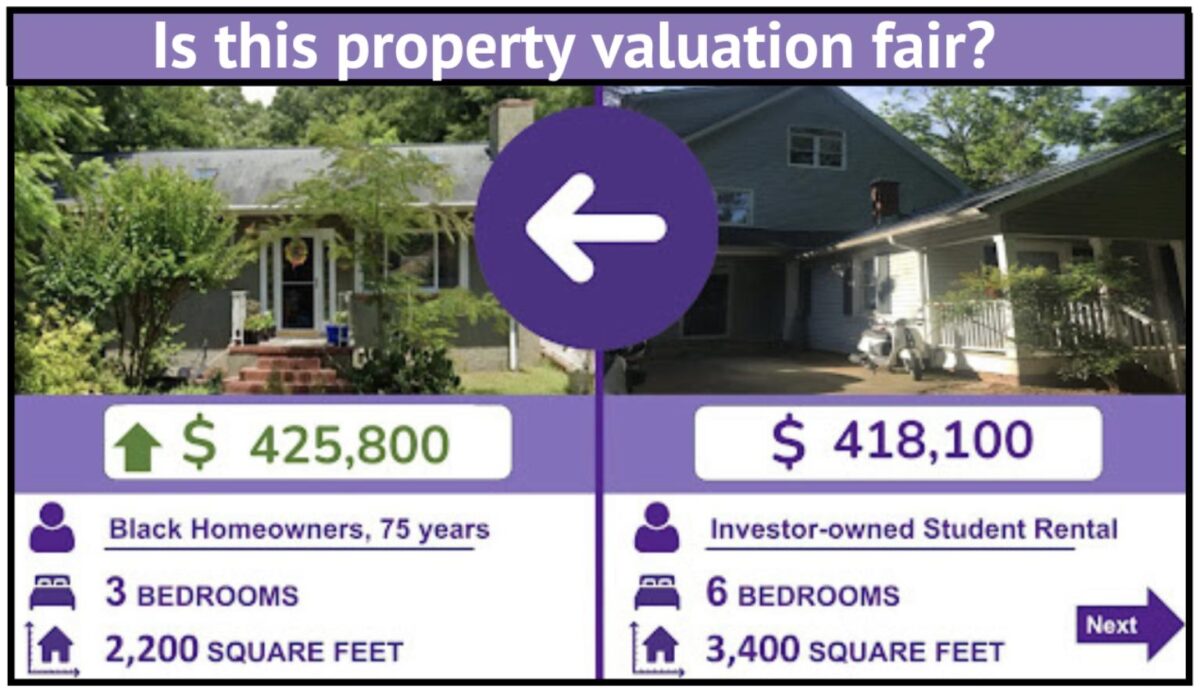

As we detailed in our previous post, Orange County has sent out property revaluation notices with significant increases. In 2021, when the last revaluation was completed, residents in Chapel Hill’s historically black Northside neighborhood successfully challenged significant property tax inequities. Northside homeowners saw much higher increased in property values than nearby affluent areas with typically larger homes and lots.

Led by Hudson Vaughan and the Jackson Center, the community mobilized through educational campaigns, petition gathering, and filing 144 appeals that ultimately resulted in a $7 million reduction for overvalued homes and a $5-6 million increase for undervalued investor rental properties.

While the 2025 data are still being crunched, there will assuredly be long-term homeowners on fixed-incomes who will need help filing appeals to reduce the risk of deleterious property tax increases.

And this is where you come in!

Volunteer Opportunity

The Marian Cheek Jackson Center and the Orange County Property Tax Justice Coalition are organizing workshops to help residents in historically Black neighborhoods and other communities file informal appeals before the April 30th deadline. Workshops are being held in Northside/Pine Knolls, Rogers Road, Cedar Grove, and Hillsborough/Piney Grove areas.

Volunteer Requirements

According to George Barrett, Executive Director of the Marian Cheek Jackson Center, volunteers are ideally:

- Available to attend a 1.5-hour training and assist between now and April 30th

- Comfortable building a case for an appeal (real estate, law, land-use or housing experience helpful)

- Able to use a laptop to navigate public tax records and databases (training provided)

- Good communicators who can discuss technical housing topics with sensitivity

- Willing to attend Property Tax Workshops to help neighbors determine if they qualify for appeals

Training Sessions

Volunteer training options include:

- April 10th at 11 am, RENA Community Center in Chapel Hill

- April 11th at 3 pm via Zoom

If you can’t attend either session but still want to help, they will provide a recording of the training.

Community Workshops Schedule

At these workshops, volunteers will help residents:

- Understand the impact of new property values on their taxes

- Determine if their assessment seems fair

- Examine neighborhood-wide assessment patterns

- Learn about property tax relief programs they may qualify for

After training, volunteers can assist at these upcoming workshop locations:

– Northside/Pine Knolls: Tuesday, April 15th, 6:00-7:30 pm at First Baptist Church, Chapel Hill

– Rogers Road Community: Tuesday, April 22nd, 5:00-7:00 pm at RENA Community Center, Chapel Hill

– Cedar Grove: Thursday, April 24th, 5:00-6:30 pm at Lee’s Chapel, Cedar Grove

– Hillsborough/Piney Grove: Thursday, April 24th, 7:00-8:30 pm at Piney Grove Missionary Baptist Church, Hillsborough

How to Get Involved

Volunteers can sign up for training through an online form that asks for your name, contact information, and which training session you can attend:

- In-person: Thursday, April 10th, 11am-1pm at RENA Community Center (101 Edgar St, Chapel Hill)

- Virtual: Friday, April 11th, 3pm-4:30pm via Zoom (link will be sent after registration)

If you can’t make either training but still want to help, there’s an option to indicate this on the form.

The training will cover:

- Background on the revaluation and appeals process and inequities in mass valuations

- Orientation to tools built to help residents understand the estimated impact of their new valuations on property taxes, qualification for relief programs, and whether their values and neighborhood values seem fair based on comparable sales and data analysis

- Information on property tax appeals and the support process

Once you register for a training, you can sign up to help at any of the four upcoming workshops listed above (there are also Durham workshops available).

For additional information, you can also contact the Marian Cheek Jackson Center at (919) 960-1670.